The Importance of Trusted User Identity Verification to Counter Fraud in the Financial Sector

The Importance of Trusted User Identity Verification to Counter Fraud in the Financial Sector Infographic by Ipsidy

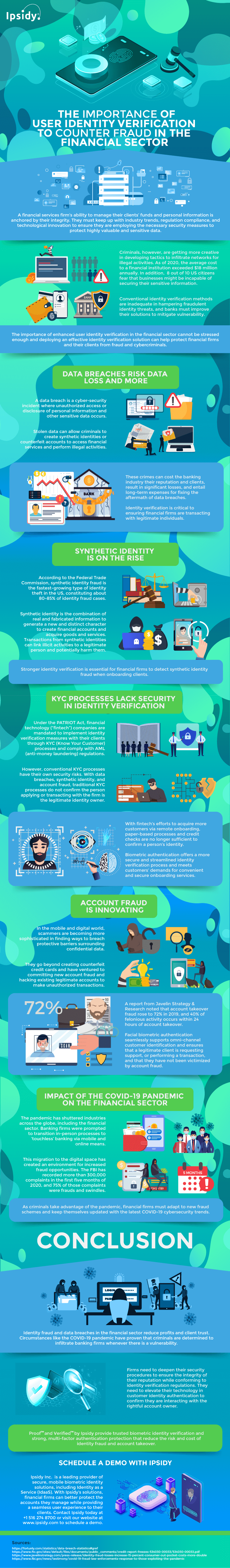

Identity verification is not new, particularly in the banking sector. It is also known as the KYC (Know Your Customer) process, which is a requirement in processes and procedures to ensure that a person’s identity matches the one that is making the transaction.

The identity verification process allows firms to authenticate that the person opening a bank account, or withdrawing funds is the real identity owner, avoiding the risk of fraud. Identity authentication takes place when a customer produces a valid ID and other documents during the onboarding process or transaction.

However, the KYC process and other conventional identity verification methods are inadequate in deterring fraudulent identity threats, particularly when firms and customers shift to using digital channels for their bank transactions.

Cybercriminals have seen the shift of banks and their clients to electronic banking as an opportunity to develop creative approaches to infiltrate networks for their fraudulent activities. According to the 2020 Identity Fraud Survey Report from Javelin Strategy and Research, the total identity fraud reached $16.9 billion in 2019, with a 79% rise in account takeover fraud.

Online fraudsters steal personal information and other sensitive data through a data breach. It allows them to create synthetic identities or fake accounts to access services and perform illegal activities. Synthetic identity fraud is the fastest-growing type of identity theft in the US, with the Federal Trade Commission indicating that it constitutes to about 80-85% of identity fraud cases.

Hence, the financial sector needs to have multi-factor authentication solutions to ensure sufficient verification. Enhanced identity verification can help protect financial firms and their clients from fraud and cybercriminals.

Biometric authentication offers a more secure and streamlined identity verification process. Meanwhile, facial biometric authentication supports omnichannel customer identification and ensures that a legitimate client is requesting support or performing a transaction.

More substantial identity verification is essential, especially during the pandemic as many industries, including the banking sector, have transitioned from in-person processes to ‘touchless’ transactions instead. Financial firms must adapt to new fraud schemes and keep themselves updated with the latest COVID-19 cybersecurity trends.

Financial services firms must also keep up with industry trends, regulatory compliance, and technological innovations to ensure that they are employing the necessary security measures to protect their reputation and highly valuable and sensitive data. Stringent identity authentication processes can mitigate fraudulent actions and meet customers’ demands for convenient and secure services. This infographic from Ipsidy discusses the importance of trusted user identity verification to counter fraud in the financial sector.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0