Pros and Cons of Investing in a Fixer-Upper in Virginia

Fixer-upper houses have their own set of advantages and disadvantages. Learn more about them before investing in a fixer-upper in Virginia.

As a real estate investment strategy, buying a house in need of repair and fixing it up to sell or rent it out might pay off. They provide an opportunity to acquire a home in need of extensive renovation. They invest in the upgrades and earn a return on their money through a higher asking price when they resell the property. This means the home may be rented out for more money or resold for a profit. Let's examine the pros and cons of investing in a fixer-upper in Virginia, so you can decide if it's the right real estate investment strategy for you.

Pros of investing in a fixer-upper in Virginia

Bargain-priced purchases

The low cost is a key benefit. If you want to buy a property but don't have a lot of money, buying a fixer-upper might be a great option for you. Sometimes the asking price is far lower than the actual market value because of necessary renovations. Anyone desiring to upgrade from a studio to a one- or two-bedroom apartment or intending to start investing in real estate may profit from this. The fastest way to pack up and relocate long distances should be second nature to you. Even if the process is sluggish, there are techniques to make it quicker. If you're working with a tight budget, this perk might be crucial.

Paying less in taxes

Stamp duty is a form of property tax calculated on the final sales price of a home. Therefore, a fixer-upper will save you money on taxes compared to a turnkey home. Since first-time buyers do not have to pay stamp duty on homes costing up to $300,000, they cannot take advantage of this additional perk. If the value of the property is $450,000, they will pay no stamp duty on the first $300,000 and 5 percent on the remaining $150,000. However, some clients might see significant savings. It is possible to get your value-added tax (VAT) back if you repair a damaged, abandoned house that has been sitting empty for at least ten years or if you convert a building into a residence.

Altering colors and other details is easy

The adaptability that comes with a fixer-upper purchase might make it a great financial decision. Throughout the course of the renovation, you are free to put money into whichever parts of the house strike your fancy. You are in no way compelled to purchase the completed product.

Any part of the house, including the bathrooms, may be changed as you see fit. Whether you're a buyer or an investor, being able to tailor the home to your specific needs can have lasting repercussions.

The opportunity to move to a more desirable area

A fixer-upper's price tag will be established by its location. Remember that if you're on the lookout. If none meet your requirements, you could want to look at residences with potential issues because they typically sell for considerably less money.

The degree of your involvement is entirely up to you

If you are handy or want to build a long-term project for your home, you may be able to save money by doing it yourself. To achieve this, you can upgrade the system on your own. In most cases, it's best to have a pro take care of your plumbing and electrical needs at home. If you're handy and have some spare time, you may paint the inside and outside of your home on your own.

Cons of investing in a fixer-upper in Virginia

Upgrades and maintenance don't come cheap

The total cost of house improvements might easily go beyond the set budget. You should try to stay away from homes that would require major renovations that might end up costing more than the property itself. Renting climate controlled storage in Virginia during renovations is highly recommended. Finding a unit that's right for you will make the process much easier. But as we'll see in the following section, this isn't guaranteed—the possibility of unplanned costs, especially when buying a partially completed home.

Financing becomes increasingly difficult

Financing a home that needs work may be more challenging. In order to qualify for a mortgage to fund improvements, certain banks like HSBC need a house to be "livable" or equipped with a fully functional kitchen and bathroom. It's possible to have your mortgage payments halted if you try to buy a property that is in bad shape. This situation is referred to as "mortgage retention." The lender may withhold a portion of the loan proceeds until conditions are met. A surveyor may propose that the lender set aside $4,000 for electrical rewiring even though the appraised value of the house is $200,000. It is possible that the owner may need to take out a loan to cover the shortfall. The loan converts to a standard mortgage once construction is finished and the lender releases any remaining reserves.

The process is lengthy

It's normal for a new homeowner to want to immediately start making connections with others around them after closing on a house. Putting up a lot of effort can be necessary (for months or years). You may, however, turn a fixer-upper into your dream house. One option is to postpone your move. As for the other, it's adjusting to life in the midst of a construction zone.

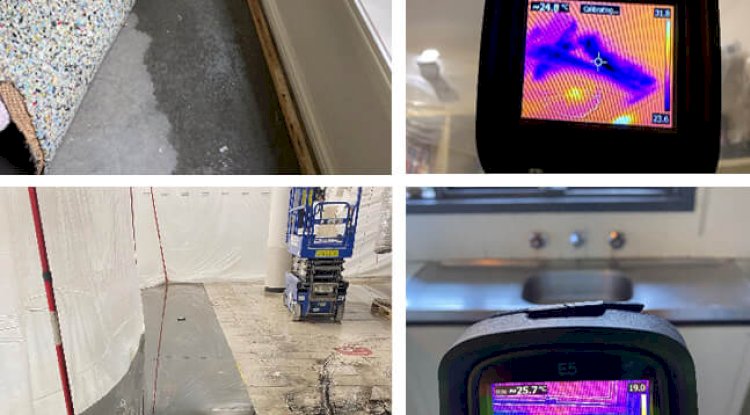

Unplanned problems

A lot of the problems with fixer-uppers aren't obvious at first glance. It's possible to find out you need a lot of expensive repairs even after a home inspection. Some difficulties may result in increased costs, such as a pest infestation. Because of this, it's possible that the project's profitability will suffer if you end up spending more than you planned.

In conclusion

Investing in a fixer-upper in Virginia requires a lot of money. Also, once you put your name on the dotted line, it's final. You have made a promise that will last for a considerable amount of time—maybe months or even years. A fixer-upper may be the way to get the house of your dreams, but only if you're willing to put in the time and effort. It offers certain advantages over buying a "turnkey ready" house. This post will hopefully give you a better sense of whether or not purchasing a fixer-upper is a good option for you.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0